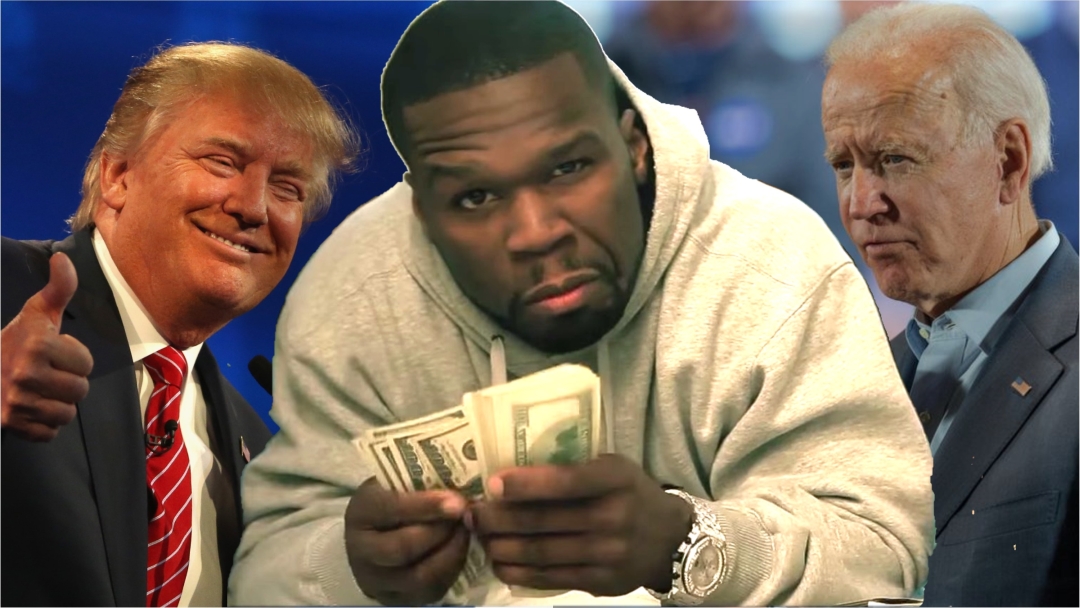

Recent events show 50 Cent endorsing Trump, not understanding how taxes work and going to leave the US if Biden wins.

It all started when Fifty had a look at a quick recap of Biden’s tax plan on CNBC business news programme. His immediate reaction was to endorse Trump, fully knowing that his presidency has been damaging for Black people:

WHAT THE F*CK! (VOTE ForTRUMP) IM OUT, F*CK NEW YORK The KNICKS never win anyway. I don’t care Trump doesn’t like black people 62% are you out of ya fucking mind.

👀WHAT THE F*CK! (VOTE ForTRUMP) IM OUT, 🏃♂️💨F*CK NEW YORK The KNICKS never win anyway. 🤷🏽♂️I don’t care Trump doesn’t like black people 62% are you out of ya fucking mind. 😤 pic.twitter.com/uZu02k2Dlz

— 50cent (@50cent) October 19, 2020

The next moment Fiddy’s endorsement was all over the media. President’s son gleefully retweeted (and deleted) the meme with Ice Cube and Fifty in photoshopped MAGA hats. The flashy headline “50 Cent doesn’t want to be 20 Cent” by the way, did not originate from Fifty, that was Katrina Pierson, American Tea Party activist and the spokesperson for the Donald Trump 2016 presidential campaign, who came out with this catchy phrase, deliberately misleading and aimed to alarm people. 50 Cent, however, got this bait and tweeted the segment from Fox News, confirming that yes indeed, he did not want to be 20 cent.

👀Yeah, i don’t want to be 20cent. 62% is a very, very, bad idea. 😟i don’t like it ! #abcforlife nov 18 #starzgettheapp pic.twitter.com/y9TsSs0o6Q

— 50cent (@50cent) October 20, 2020

Since then Fifty considered Texas as his future, more comfortable taxwise residence, asked an attorney and journalist Ari Melber to explain to him how taxes work and received an offer from his ex Chelsea Handler to pay his taxes if he reconsiders his sudden political awakening.

Hey fucker! I will pay your taxes in exchange for you coming to your senses. Happily! Black lives matter. That’s you, fucker! Remember? https://t.co/uQsu7DHrRQ

— Chelsea Handler (@chelseahandler) October 21, 2020

Maybe Melber slid into Fifty’s DMs to explain to him that taxpayers in California, New Jersey, and New York City earning more than $400,000 a year could face combined state and local statutory income tax rates of more than 60% on the amount of money above the threshold. And that the effective tax rate would increase from 26.8% to 39.8% for the top 1% of taxpayers.